How To Start A Foundation In Canada

Starting a foundation in Canada is a clear way to support causes that matter to us. It involves creating a registered charity that can raise funds and make grants or carry out its own charitable work.

The essential steps include incorporating a legal entity, applying for charitable registration with the Canada Revenue Agency (CRA), and setting up proper governance and funding.

Foundations come in two main types: private foundations, usually funded by an individual or family, and public foundations, which rely on donations from the public. Each has different rules about funding sources, governance, and operations, but both offer tax benefits and the ability to issue official donation receipts.

We will guide you through the process, including legal requirements, costs, and timelines. Understanding these details helps us make informed choices and set up a foundation that fits our goals.

Understanding Foundations in Canada

Do you want to start a foundation in Canada? If yes, you have come to the right place! This guide will provide you with the necessary steps to establish a foundation in Canada.

What are Foundations in Canada?

Foundations in Canada are set up either as trusts or corporations with the main goal of donating funds to qualified donees or conducting their own charitable activities.

How are Private Foundations Different from Charities?

Charities receive donations from various sources and actively engage in charitable work, whereas private foundations are typically funded by a single individual or family and may not directly carry out charitable activities (though they would be allowed to carry out charitable activities if provided for in their mandate).

Foundations in Canada play a key role in the charitable sector. They provide funding, support various causes, and follow specific legal and financial rules.

It’s important to understand the types of foundations, how they operate, and what role charities play in this landscape.

Types of Foundations

In Canada, foundations are registered charities that fall into two main categories: private foundations and public foundations. Both can be set up as trusts or corporations, but their funding sources and operations differ.

Private foundations are usually funded by a single donor, family, or corporation. They focus on making grants to other qualified organizations or sometimes run their own charitable activities.

Private foundations face stricter rules, such as annual spending requirements and limits on business activities.

Public foundations raise funds from the public, including individuals, organizations, and corporations. They often support multiple charities by granting a large portion of their income.

Public foundations generally have more donors and operate with greater public accountability.

Public vs. Private Foundations

The main difference between public and private foundations lies in their funding and governance.

| Aspect | Private Foundation | Public Foundation |

|---|---|---|

| Funding Source | Mainly one individual/family/corp. | Funded by multiple public donors |

| Control | More controlled by founders | Governed by a board with many unrelated members |

| Spending Requirements | Must spend 3.5% of assets annually | Same 3.5% spending rule but usually more flexible |

| Activities | Often focused, fewer programs | Broader range of charitable activities |

| Tax Regulations | Stricter limits on business and political activities | More operational freedom |

Private foundations offer more control to founders but require sufficient initial funding. Public foundations depend on broad community support and follow different governance rules to maintain charitable status.

Role of Charities in the Sector

Charities in Canada include foundations and other groups that perform charitable work. Foundations mainly provide funding to these charities or run their own programs to serve public causes.

Registered charities deliver services, fund research, and support communities. Foundations help channel funds effectively and must register with the Canada Revenue Agency (CRA), which oversees compliance and grants charitable status.

Charitable registration allows foundations to issue donation receipts and receive tax benefits. This encourages philanthropy and makes it easier for individuals and corporations to support causes through foundations.

Steps to Start a Foundation in Canada

1. Seek Professional Guidance: It’s recommended to consult with a charity lawyer or someone with a comprehensive understanding of Canadian charity laws and regulations regarding foundations before beginning the setup process. This will help ensure that you comply with all legal requirements and regulations and avoid any potential legal issues in the future.

2. Understand Legal Obligations: All foundations in Canada must register with the CRA Charities Directorate as charities, which entails specific advantages and responsibilities. Failure to register as a charity subjects the foundation to income tax obligations and restricts its ability to issue tax receipts to donors.

3. Establish the Foundation: Establish the foundation as a legal entity, either as a nonprofit corporation or trust, in accordance with provincial, territorial, or federal legislation.

4. Apply for Charitable Registration: Apply for charitable registration through the Canada Revenue Agency (CRA). The application process involves providing comprehensive documentation and outlining the intended activities of the foundation. The CRA determines the charity’s designation, whether it’s a charitable organization, public foundation, or private foundation, based on factors such as funding sources and operational goals.

Key Legal and Regulatory Requirements

Starting a foundation in Canada means following clear rules set by the government. We need to create solid governing documents, define charitable purposes, and work closely with the Canada Revenue Agency (CRA) to meet all legal standards.

Legal Structure and Governing Documents

Foundations must choose the right legal structure. Most are incorporated as either a charitable organization, public foundation, or private foundation.

Incorporation provides limited liability and formal recognition under Canadian law.

We draft key governing documents, including the letters patent or articles of incorporation. These documents explain the foundation’s mission, rules for operation, and power limits.

They must include legal objects that describe the foundation’s charitable purposes in clear terms.

Our governing documents set out the board’s powers and responsibilities. They ensure compliance with CRA rules and relevant provincial laws.

Independent legal advice helps avoid costly mistakes and ensures all regulatory requirements are met.

Charitable Purposes and Eligibility Criteria

To qualify as a registered charity, a foundation’s purposes must fall within categories approved by the CRA. These include relief of poverty, advancement of education, advancement of religion, and other community benefits.

We need to state our charitable purposes precisely because they define what activities we can legally carry out. The CRA reviews this carefully during registration.

The foundation must operate exclusively for charitable purposes and benefit the public. Foundations that serve private interests or individuals generally won’t qualify.

Meeting these criteria is essential to obtain and maintain charitable registration. This gives tax advantages and allows official fundraising.

Working with the Charities Directorate

The Charities Directorate of the CRA oversees all registered charities, including foundations. We submit a detailed application, providing governing documents, descriptions of activities, and financial plans.

After registration, we file annual returns and financial statements with the Directorate. These reports show compliance with Canadian charity law.

Failure to follow their rules can result in penalties, loss of registration, or other sanctions. The Directorate also provides guidance and tools to help us meet reporting and operational standards.

Staying in regular contact with the Charities Directorate benefits our foundation’s transparency and long-term stability. It helps us maintain public trust and comply with Canada’s charitable regulations.

Understanding Registered Charity Designations

Registered charities in Canada are categorized into three designations:

Charitable Organization:

– Established as a corporation, trust, or under a constitution.

– Primarily conducts its own charitable activities and receives funding from various donors.

– More than 50% of its directors, trustees, or officials maintain arm’s-length relationships.

Public Foundation:

– Established as a corporation or trust.

– Allocates more than 50% of its annual income to other qualified donees, typically other registered charities, while also engaging in charitable activities.

– Maintains arm’s-length relationships among the majority of its directors, trustees, or officials.

Private Foundation:

– Established as a corporation or trust.

– Conducts its charitable activities or funds other qualified donees, often other registered charities.

– Less than 50% of its directors, trustees, or officials have arm’s-length relationships, or a significant portion of its funding comes from a controlling individual or group.

Financial Considerations for Establishing a Foundation

Setting up a foundation in Canada often requires the expertise of financial or legal professionals. Costs may vary, with legal fees ranging from $5000 to $15,000 for comprehensive assistance. We recommend obtaining 3-5 quotes from charity law firms to find the best fit for your legal needs. Additionally, incorporating a Canadian nonprofit without charity status typically incurs legal fees of $2,000 to $3,000.

Tax Implications for Nonprofits in Canada

Nonprofit organizations and registered charities, including foundations, in Canada are generally exempt from paying income tax under Section 149 of the Income Tax Act.

Application and Registration Procedures

Starting a foundation in Canada involves precise steps to become a legal and tax-recognized entity. We need to handle registration with the Canada Revenue Agency (CRA), secure charitable status, and set up a dedicated foundation account to manage finances transparently.

Registering with the CRA

Our first step is to register the foundation with the Canada Revenue Agency (CRA). We submit Form T1789, the Application to Register a Charity Under the Income Tax Act.

The form asks for detailed information about our organization’s structure, including governance and decision-making processes.

We must prepare and include key documents such as the foundation’s governing documents, a description of activities, and financial plans. The CRA uses this information to confirm that our foundation meets the legal requirements.

Completing the application carefully is essential because any missing or incorrect information may delay the process. The CRA reviews applications thoroughly, and it can take several months before we receive approval.

Obtaining Charitable Status

Obtaining charitable status allows us to issue official donation receipts and receive tax benefits. Our application must show that the foundation’s activities serve charitable purposes recognized by Canadian law, such as education, relief of poverty, or advancement of religion.

Once registered, the foundation must meet CRA compliance rules, including filing annual information returns and ensuring funds are used for the stated charitable purposes.

Charitable status also means public accountability. We must keep detailed records, submit reports on activities, and be transparent about our governance and finances.

Foundation Account Set-Up

After registration, we set up a separate bank account dedicated to the foundation. This “foundation account” keeps all donations and expenditures separate from personal or business finances.

Using this account helps us maintain clear financial records for CRA reporting and audit purposes. Many financial institutions offer accounts for non-profits, which can include features like no monthly fees or cheque-writing privileges.

We should also put internal controls in place, like authorizations for expenditures and regular reconciliations. These steps build trust with donors and the CRA, ensuring funds are managed and accounted for properly.

Benefits of Establishing a Foundation

Starting a foundation in Canada offers numerous advantages, such as:

a. Promoting Positive Change: Foundations enable individuals or families to contribute to charitable causes and create a lasting impact.

b. Family Involvement: Private foundations often involve multiple family members, promoting a sense of unity and philanthropic values across generations.

c. Tax Benefits: Foundations enjoy tax advantages, including donation receipts, charitable tax credits, and exemption from income tax.

d. Control and Decision-Making: Foundation founders retain control over ownership and decision-making processes, ensuring alignment with their philanthropic vision.

Fundraising, Management, and Ongoing Compliance

When running a foundation in Canada, we must carefully manage fundraising, investments, and legal requirements. Staying organized helps secure funding, meet government rules, and maintain public trust.

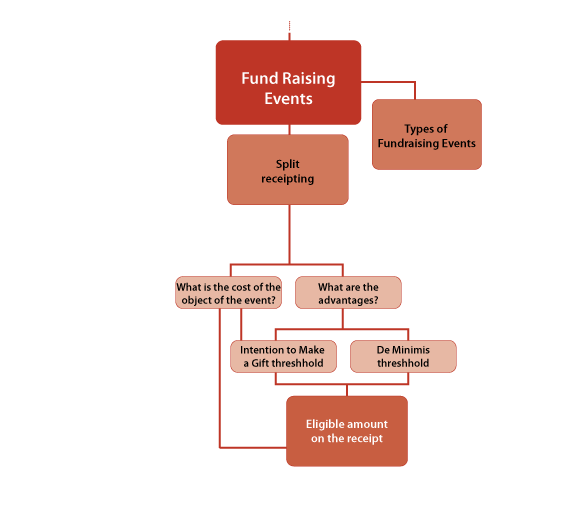

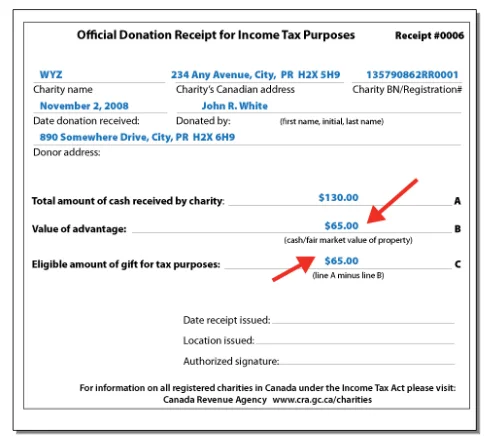

Tax Receipts and Reporting

We can issue official tax receipts to donors once our foundation is registered with the Canada Revenue Agency (CRA) as a charity. These receipts allow donors to claim charitable tax credits on their income taxes.

The CRA requires us to keep accurate records of all donations and issue receipts promptly. We must ensure our receipts meet CRA standards, including the donor’s name, amount donated, and the foundation’s registration number.

Failing to comply with CRA rules on tax receipts can lead to penalties or loss of charitable status. We also report annually to the CRA’s Charities Directorate, showing how donations were used and confirming our ongoing charitable activities.

Investment and Grantmaking Practices

Our foundation must follow strict rules about investing and distributing funds. The CRA requires foundations to spend at least 3.5% of their assets each year on charitable activities or grants to qualified donees.

We should set clear investment policies to balance growth and risk. Investments must align with the foundation’s charitable purposes and not jeopardize its tax-exempt status.

Grantmaking decisions should be transparent and based on objective criteria. We need to document how grants support our charitable goals and ensure recipients are eligible under CRA guidelines.

Proper management prevents conflicts of interest and maintains donor confidence.

Annual Reporting and Transparency

Each year, we file a T3010 Registered Charity Information Return with the CRA. This report provides financial statements, descriptions of our programs, and governance information.

Transparency is critical. Our annual reports must show how funds were raised and spent.

We must disclose executive salaries, conflicts of interest, and fundraising costs.

The CRA monitors these reports to ensure compliance. Incomplete or late submissions risk investigations, penalties, or revocation of charitable status.

Communicating openly with donors and the public strengthens our foundation’s reputation.

Special Considerations in the Canadian Context

When starting a foundation in Canada, there are important cultural and legal factors to keep in mind. Indigenous rights, treaty obligations, and relationships with existing foundations shape how we design and operate our organization.

These factors guide how we support communities and respect nation-to-nation agreements.

Supporting Indigenous Peoples and Treaty Considerations

In Canada, Indigenous peoples have unique legal rights protected by treaties and the Constitution. Our foundation must recognize these rights when engaging in projects that affect Indigenous communities.

This means respecting treaty agreements and ensuring we consult relevant Indigenous groups before starting any work on their lands or involving their people.

Supporting Indigenous peoples can include funding programs for education, health, or cultural preservation that align with their priorities. We should also consider co-developing initiatives with Indigenous partners to reflect their knowledge and perspectives.

This approach honours Indigenous sovereignty and strengthens trust between our foundation and the communities we serve.

Nation-to-Nation Relationships

Canada’s government recognises Indigenous peoples as distinct nations with their own governance systems. Our foundation can benefit by acknowledging these nation-to-nation relationships.

We should work collaboratively with Indigenous governments. This means treating Indigenous leaders as equals in decision-making.

We must design our foundation’s governance and funding policies to reflect this respect. Engaging in early dialogue with Indigenous nations helps us align projects with their goals and values.

Recognizing nation-to-nation relationships reduces misunderstandings and legal issues. This approach ensures our foundation operates fairly and responsibly.

Collaborating with Established Foundations

Partnering with foundations that focus on Indigenous or treaty-related causes is a practical step. Established foundations have expertise, networks, and trust with communities and governments.

We can collaborate through joint funding, shared governance, or by supporting ongoing programs. Working together helps us avoid duplicating efforts and maximise our impact.

We also learn from their experience with legal requirements and cultural sensitivities. This collaboration creates stronger, more sustainable projects for the communities we aim to support.

Conclusion

Establishing a foundation in Canada requires careful consideration, planning, and adherence to legal regulations. Seeking professional guidance, understanding legal obligations, and applying for charitable registration are crucial steps in the process. While there are financial and administrative considerations involved in setting up a foundation, the benefits of creating a lasting impact, promoting philanthropic values, and enjoying tax advantages make it a worthwhile endeavor.

Looking to start a foundation in Canada? The experienced charity lawyers at Northfield & Associates have set up numerous foundations across Canada, for philanthropists in Toronto, Vancouver, Montreal, Ottawa, Calgary, Winnipeg, Mississauga and more. Our team has incorporated and filed Foundation registration applications in as little as 3 days. Our process is streamlined and fast, and we can register your foundation typically in 3-4 months (unless there is a CRA backlog, which happens from time to time) from the time we are engaged.

Schedule your FREE consultation

Frequently Asked Questions

Starting a foundation in Canada involves legal steps, funding requirements, and registration with the Canada Revenue Agency (CRA). You must decide the type of foundation and understand the costs and operations involved.

How do you start a foundation in Canada?

We begin by choosing the foundation type: private or public. Next, we incorporate the foundation as a trust or corporation under federal or provincial law.

Then, we apply for charitable registration with the CRA and set up governance structures. Adequate funding to meet legal requirements is essential.

What is a foundation in Canada?

A foundation is a registered charity created to support charitable causes. It can be public, receiving donations from the public, or private, mainly funded by one individual, family, or corporation.

Foundations make grants or run their own programs to fulfill their mission.

How to set up a charitable foundation in Canada

We must establish a legal entity and draft governing documents. Then, we apply for charitable status with the CRA.

This process includes proving the foundation’s purpose is charitable and meets CRA guidelines. Proper governance and funding plans are critical for approval.

How to register a foundation in Canada

Registration requires submitting an application to the CRA with detailed documentation. We provide information about the foundation’s structure, activities, funding sources, and governance.

The CRA reviews the application to confirm it meets legal and charitable standards.

How much does it cost to start a foundation?

Legal and registration fees typically range from $5,000 to $15,000. This includes incorporation costs, legal advice, and CRA application fees.

Ongoing costs like accounting and administration should also be considered before starting.

How do charitable foundations work?

Foundations collect funds and use those to support charitable activities or grant other registered charities. Private foundations mainly fund others or operate their own programs under strict rules.

Public foundations raise money from many donors and support multiple causes.

What does a foundation do?

A foundation supports charitable causes by making grants, running programs, or both. It helps individuals, families, or communities create lasting social impact.

Foundations may also engage family members or donors in philanthropy and manage donated assets responsibly.

How to create a foundation in Canada?

Start by planning the charitable purpose of your foundation. Next, incorporate the organization.

Apply for registration with the CRA. Make sure you follow federal or provincial laws.

Prepare to meet operational and fundraising requirements. Seek professional advice to help with the process.

Disclaimer: The information contained in this article is provided for general information purposes only and does not constitute legal or other professional advice. Readers should seek tailored legal advice in relation to their personal circumstances.

At Northfield & Associates our expert teams guidance on compliance requirements. Our team understands Canadian law and can help ensure your organization follows proper procedures.

Get professional support today

Email info@northfield.biz

Phone (416) 317-6806

Visit us https://www.northfield.biz/

Appointment Schedule your free consultation

To discuss your specific circumstances and receive expert assistance throughout the reinstatement process with our experienced legal team.

| READY FOR BETTER NONPROFIT REPORTING? |

| At Northfield & Associates, we have a team of professional bookkeepers and accountants to help your organization manage the books so that you can breeze through tax season. |

| GET IN TOUCH |

What We Do!

We’re often asked by prospective clients what our Bookkeeping service. People want to know what specific tasks we do, and what their responsibility is. This brief explainer page will answer that question. This is by no means an exhaustive list, but covers the most frequently asked questions.

Getting Started

- Review your existing books for needed corrections or back-work

- Chart of accounts setup or amendment

- Assistance with setting up bank feeds

- Limited assistance* with setting up payroll (QBO or Gusto only)

- Your books brought current and reconciled if needed

Ongoing Monthly Bookkeeping

- After-the-fact transaction recording

- Post to general ledger

- Post to other ledgers (as needed)

- Bank account reconciliation

- Monthly financial statements

- Other bookkeeping services, as required

- Best-practice bookkeeping advice and counsel

Year End

- Assistance with 1099-NEC preparation*

- Assistance with 1099-MISC preparation*

- Year-end financial statements and period-end closing

What We Don’t Do

Pay bills

We do not offer bill-pay services at this time, nor do we manage Accounts Payable (AP) or Accounts Receivable (AR).

Payroll tax responsibility

Our bookkeepers can assist you in setting up your initial payroll service in QBO or Gusto. We are not responsible for entering payroll hours/salary, accruing payroll taxes, nor the transmittal of payroll taxes to the IRS or the state. Your full-service payroll provider (QBO, Gusto, or whatever other service a client uses) will be the responsible party for payroll and payroll tax compliance.

*Payroll deductions and benefits

We provide assistance with setting up a payroll account in either Quickbooks Online or Gusto, including entry of employee data. We do not assist in state registrations, benefits, or advise on deductions. Those service areas are provided directly by either QBO or Gusto.

Preparation of W2s

Similar to the last item, your full-service payroll provider (QBO/Gusto) is responsible for preparation of Form W2 for employees.

Sales tax reporting

For those nonprofits that sell taxable goods and/or services, your bookkeeper will assist in accounting for sales taxes collected and transmitted, but we do not prepare state sales tax reports.

Donation recording

We do not provide individual donation data entry into your neither your donor CRM nor Quickbooks Online, nor do we prepare year-end donor acknowledgements.

Administrative tasks

We cannot provide administrative services unrelated to our bookkeeping function.

Attend board meetings

Due to the constraints of time and distance, we are unable to be present, physically nor virtually, at a meeting of a client’s board of directors.*May incur additional fee per 1099-NEC or 1099-MISC.

| Let’s Collaborate & Make a Difference! |

| Partner with us to amplify your mission. Whether it’s Charity accounting, financial transparency, or strategic growth—we’re here to help you create meaningful impact. Let’s work together to build a better future! |

| Book a Call |

Contact us today to schedule your free consultation.

Working with Our Firm

In this evolving economic landscape, collaboration with our firm offers clients a strategic advantage. With Cambodia’s reform-driven investment environment and Canada’s expanding footprint in Southeast Asia, our team of experienced consultants and legal advisors provides tailored guidance to help businesses navigate cross-border opportunities. We focus in developing comprehensive legal strategies, structuring international partnerships, and ensuring compliance in emerging markets.

By leveraging our regional insight and international expertise, you benefit from a trusted partner dedicated to helping you capitalize on growth potential in Cambodia and beyond.

| Book a Consultation with Northfield & Associates |

| Your Trusted Partner in International Bilateral Relations |

At Northfield & Associates are focus in Foreign Direct Investment (FDI), international trade missions, and cross-border legal strategy. Our team of experienced consultants and legal advisors offers tailored guidance and strategic insight to help you navigate the complexities of international partnerships and development opportunities.

Whether you choose to meet in person at one of our offices or connect virtually, we provide flexible and accessible consultation options. During your session, we’ll assess your goals, review key documentation, and guide you through every stage of your FDI or trade mission engagement.

Let us help you take the next step with confidence supported by trusted legal and strategic counsel every step of the way.

Contact us today to schedule your free consultation.

| Northfield & Associates |

| Advancing Global Partnerships, Together. |

Take the First Step Today

If you believe you may be eligible for legal relief or simply need sound legal advice, we’re here to help. Contact us today to book your free consultation. Let us provide the clarity, strategy, and peace of mind you need to move forward.

We serve our clients in English, Cambodian, Vietnamese, Mandarin and Cantonese, especially in Asian clients.

- If you or anybody that you know, think that you meet the requirements and wish to receive further information.

- We can help you start the application process and confirm eligibility requirements to participate.

- We Offer Consultations & Meetings by Phone & Virtually. Affordable Fees.

| BOOK A CONSULTATION TODAY |

| Contact Northfield & Associates today to schedule a consultation with an experienced Consultant. |

| BOOK A CALL WITH A CONSULTATION |

| JOIN THE COMMUNITY OF NORTHFIELD & ASSOCIATES |

| Connect with peers and community ambassadors to hear real experiences, tips, and advice about studying abroad. |

| EXPLORE NORTHFIELD & ASSOCIATES COMMUNITY |

| CANADA IMMIGRATION CONSULTANTS |

| Northfield & Associates is a Canadian consulting firm based in Toronto, Canada. Northfield & Associates specializes in all types of immigration matters, from spousal sponsorships to refugee board appeals. With over eight (8) years of experience and an excellent success rate, Northfield & Associates is recognized as one of Canada’s premier immigration consulting firm. |

| HOW CAN WE HELP? |

| FREE IMMIGRATION ASSESSMENT |

| The purpose of the Free Assessment is to assess whether you are qualified to apply for permanent residence in Canada under the Family Sponsorship, Skilled Worker, or Business Class categories. Please choose which category you would like to be assessed under and complete all fields in the form. We will endeavor to complete your assessment and provide you with a reply within one business day. There is no charge for this service. All information provided will be kept strictly confidential. If our assessment indicates that you are qualified for immigration to Canada, we will contact you to provide further information about our services and fees. Start Your Immigration Application! |

| FREE ASSESSMENT FORM |

How can we assist you today?

Unlocking the Potential of Those Who Advance the World

Learn more about our core areas of expertise

About Northfield

Northfield & Associates International Corporation is a global consulting firm serving private enterprises, public institutions, not-for-profit organizations, and institutional capital providers. Operating across Cambodia, Canada, and global markets, the firm supports capital deployment, regulatory navigation, and enterprise decision-making in complex economic and geopolitical environments. Northfield & Associates delivers customized, execution-focused advisory solutions that drive measurable transformation, strengthen competitiveness, and enhance long-term highest value opportunities. The firm incorporates consulting, legal, regulatory, financial, and risk expertise to enable disciplined capital allocation, strong governance, and operational resilience. Northfield & Associates upholds a culture of applied insight and innovation, supporting clients across digital transformation, growth strategy, and organizational capability building. The firm advises individual, leading global corporations, midsize enterprises, government agencies, and mission-driven organizations through long-term partnerships. Enterprise-wide risk management, professional ethics, and fiduciary standards are embedded across all operations. Northfield & Associates’ diverse, globally unified teams are committed to execution certainty and sustainable, risk-adjusted returns aligned with ESG and stakeholder objectives.

NORTHFIELD & ASSOCIATES in Canada

As a global consulting firm, Northfield & Associates helps clients with total transformation, driving complex change, enabling organizations to grow, and driving bottom-line impact.

Learn about our offices in Canada, read our latest thought leadership, and connect with our team.

Forward-Looking Information

This news release contains forward-looking information. All statements, other than statements of historic fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future constitute forward-looking information.

This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company.

Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: the failure to finalize negotiations concerning the increase of the Loan or to close such transaction and the failure of the Company to complete the acquisition of the Company Facility; operating performance of facilities; environmental and safety risks; delays in obtaining or failure to obtain necessary permits and approvals from government authorities; unavailability of plant, equipment or labour; inability to retain key management and personnel; changes to regulations or policies affecting the Company’s activities; and the other risks disclosed under the heading “Risk Factors” and elsewhere in the Company’s amended annual information.

Forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Questions?

info@northfied.biz

Within Corporate Newsroom

Media Contact:

media@northfied.biz

Press contact

PR consultants

press@northfied.biz

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Northfield & Associates professionals will be pleased to discuss resolutions to specific legal concerns you may have.